S&P 500 - Cap-Weighted vs. Equal-Weighted: Which One to Choose?

When it comes to investing in the S&P 500, you have two primary options: cap-weighted and equal-weighted indices. Understanding the differences between these can help you make smarter investment decisions. Let's break it down.

Cap-Weighted Index

In a cap-weighted index, companies are weighted based on their market capitalization. This means that larger companies like Apple, Microsoft, and NVIDIA have a more significant impact on the index's performance.

Pros:

Historical Outperformance: Over the long term, cap-weighted indices tend to outperform. This is because they favor companies that are doing particularly well. For example, the tech giants have driven much of the market's recent gains.

Efficiency: These indices reflect the market's value and are often more liquid and cost-effective to invest in.

Cons:

Volatility: Because larger companies have more influence, the index can experience bigger drawdowns during market declines. If tech stocks take a hit, the entire index feels the impact.

Equal-Weighted Index

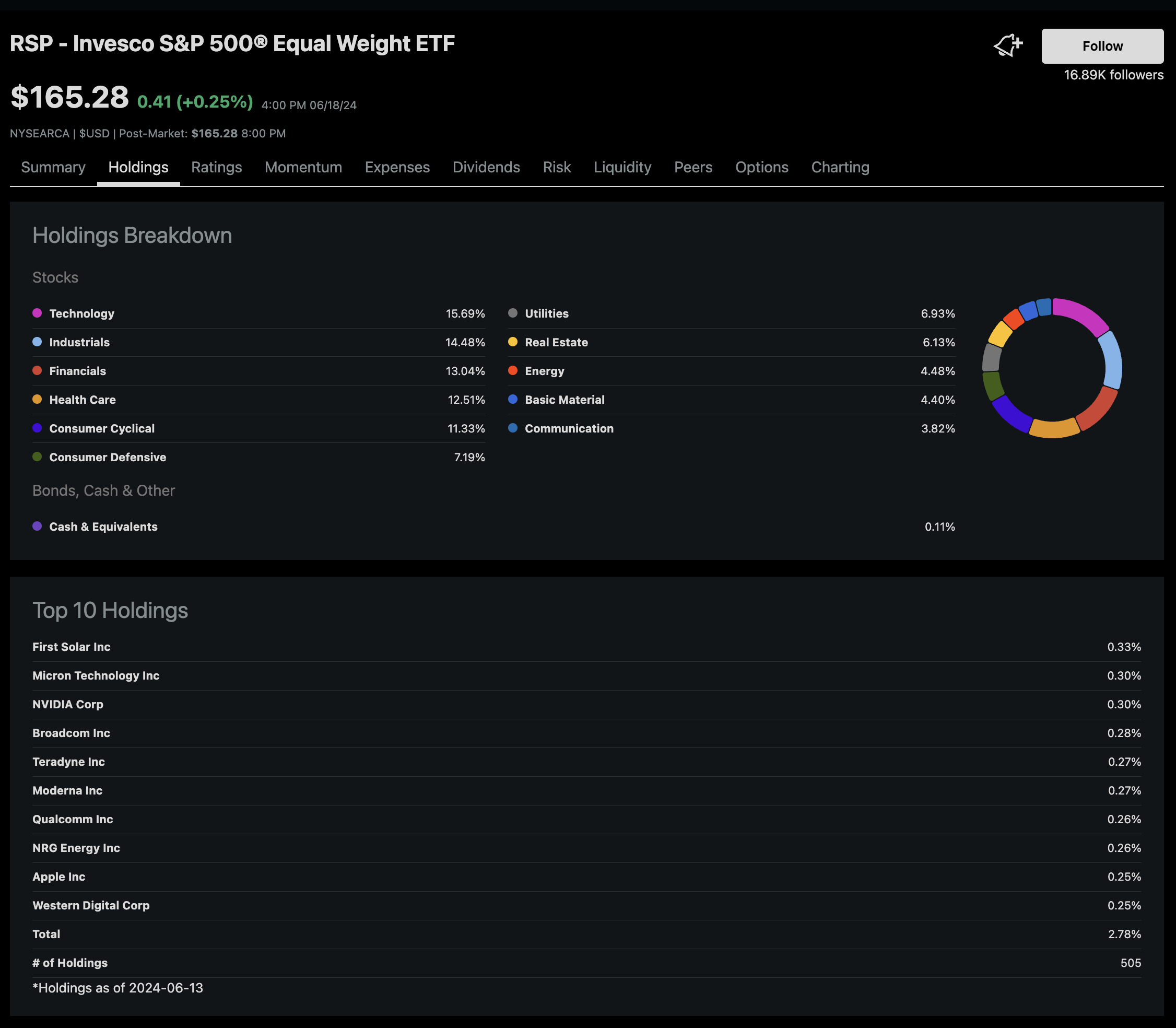

In an equal-weighted index, each company is given the same weight, regardless of size. So, NVIDIA would have the same influence on the index as a company like Coca-Cola.

Pros:

Diversification: Equal weighting reduces concentration risk. Smaller companies have more influence, which can provide more balanced growth opportunities.

Potential for Higher Returns in Small-Cap Stocks: If smaller companies outperform, an equal-weighted index can benefit more.

Cons:

Less Reflective of Market Dynamics: Since larger companies don't have more weight, the index may not reflect the true performance of the overall market.

Higher Costs: Rebalancing to maintain equal weights can result in higher transaction costs and management fees.

Why Cap-Weighted Wins Over the Long Term

Despite the potential for higher volatility, the cap-weighted S&P 500 has historically delivered better returns. Here's why:

Riding the Winners: By giving more weight to companies that are growing, cap-weighted indices capitalize on the success of market leaders. The recent surges of tech companies like Apple, Microsoft, and NVIDIA have significantly boosted the S&P 500's performance.

Market Representation: Cap-weighted indices more accurately represent the market's value, making them a better reflection of economic conditions.

Efficiency and Liquidity: These indices tend to be more liquid, making them cheaper and easier to trade.

Conclusion

While both index types have their merits, the cap-weighted S&P 500 stands out for its historical returns and ability to benefit from the success of larger, high-growth companies. Over the long term, this can lead to stronger performance, even if it comes with higher volatility during market downturns.

Stay smart and keep investing wisely.

Cheers,

Kai

Revealing my €150K Stock, ETF & Crypto Portfolio

GET MY FREE WEEKLY NEWSLETTER

Crisp, actionable tips on investing & all things money delivered straight to your inbox. No fluff, just the good stuff to fuel your financial growth! 💸